Hi all. Let me first say that I’m going to write this post in English since I’d like to refer this post to some people that don’t speak Dutch. This post is going to be mixture of ideas on important topics in finance. These ideas are not mine, obviously. They are a mix of what other people have to say about these topics. I’m warning you, this is a long post. Read it all in once, in parts, or not at all, it’s up to you.

Efficient markets

Whenever I talk to people about markets, people have strong opinions. In an article in the Financial Times, John Kay writes “In the past decade, the efficient market hypothesis has been mugged by reality”. Kay also refers to another article by John Plender, who writes: “the financial crisis put paid to [the efficient markets hypothesis]. The credit bubble before 2007 clearly pushed the price of most financial assets far from fundamental value”. In my view, these articles take inefficiency as a given instead of showing that markets are inefficient. It’s as if there is already a scientific consensus that markets are not efficient.

Let’s be clear: there is no such consensus. For example, let’s see what John Cochrane has to say. He’s a respected Chicago economist who wrote “the bible” on asset pricing. Consider this quote from a 2011 paper where he discusses the current state of affairs in asset pricing: “Informational efficiency is not wrong or disproved. Efficiency basically won, and we moved on. When we see information, it is quickly incorporated into asset prices. There is a lot of asset-price movement not related to visible information, but Hayek (1945) told us that would happen, and we learned that a lot of such price variation corresponds to expected returns”. In my opinion, one important reason why so many people are convinced that markets are inefficient is because they are not careful about definitions. Another one is that they are not careful about what type of market behavior could explain the things we observe. They see strange things and instantly attribute them to irrational markets. If only matters were that easy. When we’re talking about efficient markets, we need to be very clear about what we mean.

First of all, we’re talking about financial markets where financial assets are traded against market prices established by transactions between buyers and sellers. I’m not talking about the market for books or cans of Coca Cola. I’m talking about financial assets like stocks, bonds and options. Andreas jokingly made a comment about markets not being efficient since ScienceDirect (a giant database of academic papers) charges 39$ for a paper by Eugene Fama, which can also be found on Google for free. Other people involved in the discussion seemed to agree with the comment. Geert Janssens retweeted it, so can I assume he liked it a lot? Anyway, let’s for a minute act as if we were very serious people who took that comment very serious. First of all, a paper is not a financial asset. A book or a road map is also not a financial asset. The efficient markets hypothesis is about financial assets. Second, obtaining a paper using Google might not be legal (although I’m not 100% sure about this), meaning that you could compare it to stealing an apple. Or maybe to stealing an overripe lemon, if you don’t like Fama. Stealing is not really a transaction, is it? Lastly, and most importantly, the 39$ that ScienceDirect charges for the paper is not a market price. It’s an ask price. It’s is no more a market price as is the 450.000 EUR you would be willing to accept for your own house. A market price is established when a buyer and a seller agree on the price and a transaction takes place. However, I could imagine somebody buying the article for 39$, but again, it’s not a financial asset. It has nothing to do with efficient markets.

Secondly, let’s define clearly what efficient markets are. Efficient markets are markets in which all available information is immediately reflected into prices of financial assets. There is a weak, semi-strong and strong form of market efficiency. Each form uses a different definition of “available information”. The weak one says that all historical information is priced, so that you can’t earn abnormal returns by using technical analysis (charting, technical indicators like RSI, …). The semi-strong one says that all public information is priced, so that fundamental analysis (macroeconomic analysis, earnings forecasting, …) is useless as well: fundamentals are already reflected in the price, so don’t bother looking at them. The strong one says that private information (insider information) is also priced, so that even inside information cannot deliver abnormal returns. Forget about the strong form. It doesn’t hold in reality. Fama even admits this himself in his 1970 paper: “We would not, of course, expect this model to be an exact description of reality, and indeed, the preceding discussions have already indicated the existence of contradictory evidence”. The weak and semi-strong versions however, that’s a different story. They hold up quite well as has been shown up to this day.

Anyway, this is what academics mean when they’re talking about market efficiency. It is related to rationality in the sense that we expect information to be rationally reflected in asset prices. In other words, we don’t expect investors to multiply all numbers available to them by a random number between 0 and 2 before they start trading. We expect them to use information rationally, respecting probabilistic laws and such. Also note that rational markets and rational investors are not the same concept. Of course there’s a bunch of irrational investors out there! Kahneman and Tversky started that whole literature in their 1979 masterpiece on prospect theory. Kahneman got a Nobel Prize for that as well. But you see, just as in a poker game, there’s people all over the place trying to exploit mistakes by others. As long as there are enough rational traders with enough money, prices will reflect rational expectations. Because if prices deviate from fundamental values, arbitrageurs will come in and try to profit from mispricing, which will bring prices back to its correct level. So yes, there are irrational investors out there, but this is by no means proof for irrational markets.

Return predictability

We now move on to return predictability. Why? Well, because we also talked about that in our Twitter discussion. Jonas Deré (follow him as well!) asked me about predicting returns and compared it to the weather. You could predict that a day in January is going to be colder than a day in August. And you’d probably be right too if you live on the Northern hemisphere. But that’s because there is a trend in temperatures. We have seasons. There’s no such trend on the stock market. However, there is predictability. But first, let me distinguish two types of predictability. There is time-series predictability, which means that you can predict the evolution of returns over time. There also is cross-sectional predictability, which means that you can predict returns of individual assets or portfolios at one point in time, relative to each other. We don’t talk about predicting prices, since these just keep going up over time. We talk about predicting returns. The time-series and the cross-section are really interconnected, which is why financial economists often use large panel data sets: a bunch of assets over a large period of time. However, it’s good to understand the difference between the two dimensions.

Time series predictability

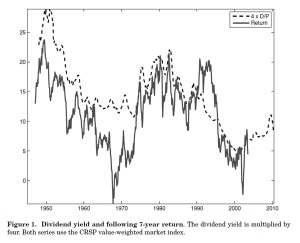

Let start with time-series predictability. Say that I found a method to predict returns of assets at future points in time. Tomorrow, next month, next year, whatever. Actually, there’s quite a lot of evidence out there that this is possible. Consider some results from the Cochrane paper mentioned earlier. A 1% increase in the dividend to price ratio of the aggregate US stock market increases future 1 year returns by 4% and future 5 year returns by about 20%. Or look at this graph plotting the dividend to price ratio of the aggregate US market in each year against the returns of the following 7 years. The conclusion is clear: dividend yields predict future returns. And for that matter: there’s other variables that predict returns as well.

People often associate efficient markets with returns that cannot be predicted. Random walks, and stuff like that. And clearly, there is predictability out there, so markets are not efficient? No, predictability is not a problem for market efficiency. The reason is simple: expected returns are time-varying. In the old days, people thought expected returns were constant. So if you would be able to predict them, there would be something wrong with market efficiency. But now, we know they are time-varying. Why are they time-varying? Well, there are a lot of possible explanations. We have rational theories involving consumption, investment, production and business cycles. We also have behavioral theories that focus on irrational expectations. We have theories about liquidity, and so on. We don’t really know that well why they move, but they move. We also know that expected returns tend to be high in bad times and low in good times, so that there’s a business cycle component tied to it. In any case, return predictability is not a problem for market efficiency, since it can exist in efficient and rational markets. Of course, it can also exist in irrational markets, which is what makes this discussion so hard but interesting. You should remember that return predictability over time is not necessary proof for irrational markets, as many people out there believe.

Cross-sectional predictability

Let’s now move on the cross-sectional predictability. Let’s say I sort all firms on their book-to-market ratio, which is the ratio of book equity divided by market capitalization. I sort from low to high, and form five portfolios with an equal amount of stocks. It turns out that portfolios with high book-to-market stocks will outperform portfolios with low book-to-market stocks. In my own European dataset covering 7.861 stocks over 30 years, the returns of the low book-to-market portfolio is about 0.80% per month (10% per annum) while the return of the high book-to-market portfolio lies around 1.40% per month (18% per annum). So there is cross-sectional predictability: book-to-market ratios predict the cross-section of returns. As it turns out, there are a lot of variables that have the power to predict the cross-section of stock returns. The most important ones are size, book-to-market ratio and momentum. Size is just the market capitalization of the firm and momentum is a measure of how well the firm performed over the last year: higher returns equal higher momentum. What are the empirical findings? Small firms earn higher returns than large firms. High book-to-market firms (value firms) earn higher returns than low book-to-market firms (growth firms). Lastly, high momentum firms do better than low momentum firms.

Is this cross-sectional predictability a problem for efficient markets? Again: not necessarily. When the variables you use to predict are related to risk, it’s not a problem. Say a firm is in distress and the market learns about this. The first thing that will happen is a plunge in the stock price, which of course causes the market capitalization to drop (the firm becomes smaller) and causing the book-to-market ratio to increase. So now we have a distressed firm that is small and has a high book-to-market ratio. Suppose you’d consider investing in such a distressed firm. The price would have to be low enough to convince you that you would be getting a reward for all the risk you’re taking. Or in other words: expected returns SHOULD be high for small firms with high book-to-market ratios, since these firms are often in distress. That’s the risk story that Fama and French came up with in 1992 and 1993. This story is compelling, also because macroeconomic factors seem to capture the same variation that size and book-to-market factors capture.

But there’s another story as well. An irrational one, best described by the paper of Lakonishok, Shleifer and Vishny in 1994. This paper is also a work of art, if you ask me. They argue that the market is not rational but rather extrapolates past earnings growth too far into the future. Firms with high past earnings growth would be expected to continue this high growth, so that they would have a high stock price and therefore a low book-to-market ratio. Likewise, firms with low past earnings growth would be expected to continue on this path, so that they would have a low stock price and therefore a high book-to-market ratio. When eventually new earnings are made public, they will be higher than expected for high book-to-market firms, causing high returns, and lower than expected for low book-to-market firms, causing low returns. So this pattern would explain the book-to-market effect as well. Why don’t the arbitrageurs come in then to correct the mispricing? Well, they argue, to profit from this effect you would need to hold your portfolio for a long time, sometimes 5 years or more. There’s no arbitrageur or fund manager out there who can convince his financiers that he’s going to make a lot of money, if he has lost money for 5 years in a row. He’d be fired, which is why he won’t undertake such a strategy. Lastly, they also show that the higher returns of high book-to-market stocks have nothing to do with higher risk. This, of course, poses a threat to the efficient markets hypothesis. Others then criticized the way they measured risk. And so on. To this day, the jury’s still out. There’s no consensus. In any case, value investing has perhaps never been more popular as it is today.

What should you remember from this? First, returns are predictable. Second, that this does not disprove market efficiency at all, since a lot of the predictability can be linked to risk and time-varying expected returns. However, not all phenomena are so easy to explain. Fama himself admits that the momentum anomaly poses a threat to market efficiency. Then again, he also states that there’s about an equal amount of overreaction-anomalies and underreaction-anomalies, which is also something you’d expect in efficient markets. Do you remember from statistics that you’ll always have a 5% chance to reject a correct hypothesis? Well, it’s about the same story here. There’s always going to be extremes at either sides of the sample that could make you think that a correct hypothesis (e.g. market efficiency) is not true. If the extremes are on both sides, it’s not a terrible problem for market efficiency. Another rational-markets argument to explain momentum is that momentum might be a noisy proxy for expected returns. If expected returns are constant (we’re pretty sure they’re not) or they are time-varying but highly persistent (which is plausible), then the buy-and-hold return of the last year (momentum) is a proxy for expected returns. If momentum is high, expected returns are high, so these stocks have higher returns. Which is what we observe. You see, it’s not easy to pick a side. Both sides can explain anomalies.

Bubbles

Lastly, let’s talk about bubbles. Before we start, let’s define them. You’ll see in a minute why a clear definition is everything but redundant. In an e-mail exchange between Eugene Fama and Ivo Welch, Fama defined a bubble as special cases of market inefficiency where cumulative returns differ predictably from equilibrium expected returns for sustained periods. Or in other words, the price is too high for fundamentals to support. It also means bubbles should be predictable in advance! So you can’t just look up a graph of some stock price, look for a plunge and scream: “IT’S A BUBBLE!” No, this is wrong because you use the advantage of hindsight. A crucial condition for you to be able to scream those words is that the bubble should be predictable. An unpredictable bubble is not a bubble. The idea here is that asset prices are just expectations about future cash flows. When these expectations change, prices change as well. So you could have a stock that plunges because irrational investors drove up the price for months and months and now finally start to see their mistake, or you could have a plunge in price because bad news reaches the market and becomes rationally reflected in prices. Both events can cause giant drops in stock price. For example, Fama argues that the 2008 drop in stock prices was due to news that a very big recession would be coming.

An example might clarify the hindsight problem. Say you buy an asset that will return $100 in a year with a 90% probability and $10 with a 10% probability. Assume that the proper discount rate is 5%. The fair value of the asset equals its expected cash flow, $91, discounted at 5%, which gives us $86.67. That’s the fair price. Now suppose we’re 6 months later and terrible news reaches the market. Suddenly, you have a 10% chance to get $100 and a 90% chance to get 10$. The discount rate stays constant. Now, the fair value drops to $18.54. Or in other words, your asset just lost about 79% of its value. Now suppose you’re an outsider with no knowledge about expectations, fundamental values, probabilities, discount rates, and so on. This all sure looks like a bubble, wouldn’t you say? How could investors ever have paid $86.67 for an asset that is now only worth $18.54? Surely they must have made a mistake. Well, as you can see, expectations were different at the beginning, perfectly justifying a price of $86.67. There was nothing irrational about this. Events with extremely small probabilities do happen, and they justify massive drops in value.

Lastly, let’s take another look at The John Plender quote I mentioned earlier: “the financial crisis put paid to [the efficient markets hypothesis]. The credit bubble before 2007 clearly pushed the price of most financial assets far from fundamental value”. How is Mr. Plender able to draw such conclusions? Did he watch prices fall by about 40% and therefore conclude that it was an irrational bubble? Because that would be silly. Did he calculate fundamental values of assets in 2007 based on 2007 expectations and did he then compare those numbers to the 2007 historical prices? I’m sure he didn’t do that. How in Gods name would he be able to price a CDO when he himself is claiming that all those PhD’s in physics, mathematics and economics were not able to do it correctly? Here’s what he did: he used the benefit of hindsight, which is wrong. If the financial crisis in 2008 had a 70% probability of happening, then yes, prices would be irrational. But did it really have a 70% of happening? Of course not. This crisis was an extreme event, with a very low probability. If it’s probability would be high, we would have these crises all the time. The question that remains unanswered is: what is the probability of such a crisis? Because if you want to evaluate observed asset prices against their fundamental values, you need estimates of probabilities of extreme events. And getting those estimates is close to impossible. So no Mr. Plender, you’re not getting off that easy. You did not show markets are inefficient.

Conclusion

Anyway, these were some thoughts on these topics. If you ask my opinion on this subject, you’ll find that I largely lean towards efficient markets. Most people in asset pricing do. But I’m not a true believer. I believe markets are efficient most of the time and that it is very hard for people to beat the market. But I’m also not convinced that markets are efficient always and everywhere. I think there’s a proper chance that some people might be able to beat the market, but that these people are extremely rare and that I will probably not be able to find them. I think there’s also a proper chance that markets have irrational expectations now and then. The thing is, I’m not sure about any of this. And that’s okay, I’m not forced to take a position on this. I think an honest view on this matter is to be agnostic. Economic science has not yet reached a conclusion and I don’t like to believe in stuff based on beliefs and nothing more than that. However, I do think that the efficient markets idea is getting a lot of discredit where none is deserved. In fact, that’s an irrationality of which I’m sure. So I’ll often play the devil’s advocate in order to give the dead sure opponents of the efficient markets hypothesis a run for their money. I hope I was able to achieve that here.

Great post (I will make it through the predictability bit at some point, to cash in all that money you promised)! A couple of thoughts: the conversation started with a tweet from Geert Janssens who said that neoclassical economics started from a misguided assumption on rational behavior. Then you made a comment which I thought was also on rational behavior. “Er is nooit een ontkoppeling geweest. Enkel een mogelijk onrealistische assumptie over menselijk gedrag. ” To which I said that isn’t wasn’t a *possibly unrealistic* assumption, but a scientifically proven one.

That’s when things got fuzzy and you dragged us all into a discussion on the efficient markets hypothesis, which I shouldn’t even have gotten into, because I endorse the semi-strong version of the EMH completely!

The only thing I still disagree with is the bubbles question: I think there might be a paradox in your definition. You say bubbles are only bubbles if you can identify them before they pop, not after. But as soon as a bubble becomes predictable, it would cease to be a bubble, because investors would change their behavior and start shorting whatever it was that was bubbling. At least that’s what your precious EMH says ;-). What I do agree with, is that bubbles aren’t necessarily the result of irrational behavior (only). Investing in bubbles can be very profitable, as long as you get out your money in time. So bubbles may be rational, and be in accordance with the EMH, fact is that they present a market failure, because prices no longer reflect value, they only reflect speculation.

Thanks for your reply Andreas! Appreciate it!

Geert was more or less right about the assumption of human behavior in economic models. Models assume rational economic ‘agents’ (I hate that word, but it keeps popping up). But agents are not always rational (shown over and over again), so the assumption is wrong. That’s completely correct. But he said that models decoupled from human nature a long time ago, which is wrong. Models always start out with some formulation of human behavior, or nature if you will. Utility functions go way back. Maybe they’re not realistic, but you can’t say they are decoupled from human behavior, like Geert did. At least not in my opinion.

However, let me make three comments about silly assumptions. First, the criticism that economic assumptions are not realistic is pretty old. It’s been around for decades. But it was Milton Friedman already a long time ago who said in “The Methodology of Positive Economics” that economics models should be validated based on their predictions, not on their assumptions. Some assumptions may seem unrealistic, but maybe that’s not really a problem. Maybe a wrong assumption is not really a problem when predicting outcomes, although it often simplifies the math a lot. When I talk about simplifying math, I’m not just talking about being too lazy to work out all the formulas. It’s more like: we only have formulas with those simplifying assumptions. Otherwise we don’t have anything at all. Second, when we talk about prices of financial assets, irrational behavior might not be a problem. As long as there are rational people with enough money, prices will be correct. I explained this in the blog. When we talk about other prices like books or computers, there might be a lot of inefficiencies. There’s also so much heterogeneity out there in regular products that you can’t find in asset prices. An asset is the same everywhere, while a Big Mac or a can of Coke have different tastes in different countries. Third, let me bitch a bit about “scientifically proven”. I don’t like that word as well, as students find out when they write stuff like that in their thesis. You can’t prove anything with the scientific method. You can only temporarily accept a theory. But that doesn’t mean it’s proved to be correct. You just haven’t found anything to disprove it: all your observations are in line with the theory. So I don’t like the word “proven”, but to be fair, I’m really being a bitch here for bringing this up! 🙂

Lastly, let me comment about that bubble thing. You made an excellent observation. If bubbles would be predictable, wouldn’t they go away? Well, I don’t think so. Couldn’t it be that bubbles are created by a large mass of irrational investors, while rational investors are able to predict the bubble but not be able to change it? Maybe they don’t have the money to act on the mispricing, maybe they don’t want to take the risk (arbitrage is seldom a sure thing), or maybe arbitrage is just not possible due to shorting restrictions or whatever? It’s like what Keynes said: maybe the markets behaves irrational longer than you can stay solvent. Or maybe they just want to ride along with the wave. If a lot of zombies come running at you, you’d better run in the same direction, like Noah Smith said beautifully. So I think it’s possible for a bubble to exist and be predictable at the same time. For example, in our recently published paper, we found that stocks with lottery-like aspects are in demand with people who like that type of stocks. They bid up the price too high, but nobody is able to arbitrage the overpricing away, since it’s just too risky. As a result, you have stocks that underperform other stocks due to limits to arbitrage. I’m not saying this is the sole explanation, but it’s possible. However, I don’t think you can say that bubbles are rational but prices no longer reflect value, as you said in your last sentence. I know what you mean, but you have to be very careful about definitions here. Investing in bubbles can be rational, but that doesn’t mean the bubble itself is rational. It’s just something that started out by irrational investors and gradually, rational ones join the party. But the bubble itself is still irrational. Rational investors will make a lot of money if they get out on time, but irrational ones will lose a lot. So the bubble is irrational, even though it could partly be driven by rational guys.

Hello guys,

Finally, I found some time to react to this elaborate blog with interesting thoughts. I agree with Andreas that the discussion somehow got fuzzy and got focused on the EMH.

Anyway, do I believe in the EMH, either a strong or weaker version? As Kurt did state at the end of his reaction to Andreas, nothing can be proven. Just as we cannot prove that the markets are irrational, one cannot prove that it is rational. But stock prices are more volatile than the streams of dividends they are supposed to predict and much more than the underlying fundamentals. Stock markets appear not to be about picking the winning company in the long run and there are too many feedback mechanisms that drive them towards disequilibria. You refer to Shleifer’s 1994 paper but what about Greenwood and Shleifer’s NBER paper from earlier this year? They analyze time-series of investor expectations of future stock market returns from six data sources between 1963 and 2011. Apparently, investor expectations are strongly negatively correlated with model-based expected returns. Investors’ time varying required returns do not line up with proxies for investors expected returns. At a minimum, their evidence rules out rational expectations models in which changes in market valuations are driven by the required returns of a representative investor.

By the way, I don’t agree with your reflections on hindsight. Even an after-the-fact rationalization cannot explain why the markets are overreacting all over the time in history (Shiller in Irrational Exuberance). I don’t see either why there should be such a big difference between a paper and an asset? From the point of view of the EMH there shouldn’t be much in between.

So, is the jury still out? How strong is the case of EMH if it has to recall upon the fact that you have a 5% chance to reject a correct hypothesis? By the way, whether we can prove the irrationality of markets or not, that doesn’t take away that it appeared that the EMH failed in many respects and that the widespread believe and usage of it made financial markets vulnerable to different kinds of irrationalities. So, what’s the point here? Maybe the theory has been misused but that doesn’t take away that many of its advocates have been very eager to promote it as a useful guide for policy and still do so.

Finally, by introducing the event of ‘new news’ in the market you try to explain a bubble. But, that creates a kind of vicious circle (as Andreas noted). By definition, there will never be a bubble. Unless it is created by a large proportion of irrational investors. But, are markets efficient if irrational investors hinder the rational ones to be efficient? Strange reasoning, isn’t it?

Thanks for your reaction, Geert!

I agree that theoretically, you can’t prove or disprove the EMH. I’ve stated that in my second or third blog posts I think. It’s the joint hypothesis problem. To investigate if markets are efficient, you need a model for equilibrium returns, because you need to know which information drives returns and which information does not. On the other hand, if you want to use a model for equilibrium returns, you need market efficiency. So you’re always testing efficiency and a model at the same, never separately. So even if you reject, you will never know if it’s because your model of equilibrium returns is wrong, or if its because market efficiency never holds. It’s a big problem.

With respect to prices being much more volatile than dividend streams, that’s correct. We observe that. But it seems that a lot of price volatility is due to variation in expected returns, and not due to variations in expected dividends. All this makes sense in an efficient markets story. The EMH does not require variation in dividends to explain all variation in prices. The price of a financial asset equals the expected cashflows discounted at an appropriate discount rate. For a stock, cashflows are dividends. So stock prices can vary because future cashflows (dividends) vary a lot, but also because discount rates vary a lot. In the 70’s, people thought discount rates were constant, so that all variation in prices should be reflected in variation in dividends, which was not the case. We now know, however, that the discount rate part is much, much more important and more volatile than the dividend part. All this is possible in an efficient market;

I haven’t read the paper you mentioned, but it seems like an interesting one. However, I don’t think that markets are inefficient just because measured expectations don’t compare well to model generated ones. When we’re talking about efficient markets, the thing that we need to check is whether the true expectations are reflected into market prices. That’s the only thing that the EMH says: prices immediately reflect all information (=expectations). So maybe our models are not well at estimating expected returns, but that doesn’t mean that markets are inefficient, it just means that our models are not that good. So in this regard, I still think we can’t be sure of anything.

I don’t fully understand your next comment: “Even an after-the-fact rationalization cannot explain why the markets are overreacting all over the time in history”. Do you mean here that a lot of overreactions cannot be explained by rational stories, like the arriving of news and stuff like that? I think it’s very hard to check such things. Otherwise, Fama would be done, which he isn’t. For example, the 2008 crisis could be explained by a lot of overpriced products, but also maybe by a very large recession and increasing risk aversion (expected cashflows drop and required returns go up, pushing prices down like crazy). But anyway, we would have to look at a lot of cases to check this.

Also, let me note that the 5% chance of rejecting a correct null is not the only argument backing the EMH. It’s just one of many. The 5% argument just states that even in efficient markets, you would expect to find anomalies. The thing is, you NEED to find them on both sides: meaning OVERreaction + UNDERreaction. It’s like saying that if Coca Cola puts an average of 20 cl in its bottles, you would ocassionally expect some bottles with 21 cl and some with 19 cl. Finding these 21 an 19 cl bottles doesn’t mean the average is not 20 cl. However, if you only find 19 cl bottles but no 21 cl bottles, then there might be a problem. We find that both under- and overreaction are equally represented in the data. So actually, that’s the argument. You expect anomalies in efficient markets. If we we’re only to observe OVERreaction but not UNDERreaction (or vice-versa), the case for irrational markets would be a lot stronger… Again you argue the EMH has failed in many respects, but I’m sure you know by now that I disagree. If it were so clear that the EMH was wrong, academics would have long reached a consensus. The alternative is that academics are a bunch of fools, which I just don’t believe. So you can believe your statement, but you can’t be sure of it. The EMH has failed only if that is what you want to believe. Likewise, the EMH has done perfectly well if that is what you want to believe. That’s why both Shiller and Fama have not killed themselves yet. They both see their world view confirmed in the data. That’s why I said: it’s fair to be agnostic about this stuff, which should prevent people from being too eager to promote the theory for policy making.

I guess this discussion will never end 😀

Oh, one more thing on which I forgot to react. You mention that you think there shouldn’t be much of a difference between a paper and a financial asset. I disagree. There’s two main arguments I can come up with. The first is regarding the scope of the EMH. The second is regarding the price of the paper online.

First of all, a paper is a consumption good. You buy it so you can ‘consume’ it. A financial asset is different. You buy it and then have the right to share in a companies profits. Buying it provides you with additional future income, which after receiving it, you could spend on consumption. You could say: “Well, by reading the paper, you become smarter, and when you become smarter, you will probably earn more in the future. So buying the paper gives me additional future income.” Well, that’s true, although the effect of that one paper on your future income will probably be negligible. And the effect will certainly be negligible if you don’t believe what Fama has to say (it was a Fama paper, remember? :)). Also, it is not the act of buying the paper that provides extra future income, it’s consuming the paper that provides additional income. With a financial asset, buying it and buying it alone gives you the right to receive future income. There’s no intermediary step of reading something before earning something else. You buy the stock, you get the dividends. Would you compare a stock with the book of Schoors and Peersman, for example? I wouldn’t. Buying their book was a good decision, I learned a lot, but I wouldn’t compare the book to a financial asset. Also, and this is very important, the EMH is about financial assets that trade publically. It’s not about books, computers, cars, and so on. It says nothing about those kind of products. It’s just an hypothesis about the information that is reflected into asset prices.

Second, the 39$ price for the paper on ScienceDirect was an ask price. An ask price is never a market price. I could ask 1000$ for my computer mouse, but does that mean that the market price of my mouse is 1000$? It doesn’t. If I could find a buyer and conduct a transaction with him, however, that would be the market price of my mouse. But again, the EMH doesn’t apply to my mouse. There’s only one “my mouse” which is not trading on any exchange, while there are millions of stocks for each company, trading publically and available to all.

I think whoever put these names into writing for us didn’t want to make things easy. Best way I’ve seen it is ‘cu hoo linn’.Part of the trouble too is local dialect. I was at Irish Festival in Dallas one year and showed someone a knife I copied from an old woodcut of Irish warriors. Somebody listening corrected my pronunciation of ‘sgnsi'(akeen, basically), having spent several months recently in Ireland. Over the next two hours three other people corrected it too- all of them differently.

Pingback: Voorspelt de beursreturn in januari die over februari t/m december? | De blog van Kurt

Do Shiller or Fama incorporate self-reference into their models? IMO self-reference is needed, because while paper wealth is created by bid-ask prices moving up and the cashflows from real companies, their is also a zero-sum aspect to the game, like in poker. In poker you have alot of self-reference, basically having opinions about the other actors, or go even deeper, having opinions about the opinions of the actors.

So investors should not have only opinions about the market, but also at least opinions about the opinions of other investors on the market.

So if you want to decide if investors are rational or irrational, you have to decide if an investor that believes in rational or irrational people is rational or irrational. basically you go 1 level deep. And then to decide if those rational/irrational people are rational if they believe that people are rational/irrational if they believe in rational/irrationality. 2 levels deep. I’ve read a bit about artificial intelligence and a system should be intelligent if they can think 2-3 levels deep.

Here is a problem because the model isn’t self-referential, you get a paradox.

http://en.wikipedia.org/wiki/Russell%27s_paradox

Aha, you’re talking about multiple level thinking from poker. Level 0: what do I have? Level 1: what does my opponent have? Level 2: what does my opponent think I have? Level 3: what does my opponent think I think he has? Etc…

I don’t think that matters for the EMH itself. That just says that prices reflect all available information. That’s it. Now the problem is, as Fama always carefully points out at the beginning of interviews: market efficiency and asset pricing are joint at the hip. You need an asset pricing model to test market efficiency and you need to assume market efficiency to test an asset pricing model. The part you are talking about, I think, is asset pricing models. An asset pricing model tells you what information SHOULD be priced. When you want to test those models, of course you need to assume market efficiency, because you’ll use returns to test your model. If those returns don’t come from an efficient market, you can’t use them to test your model, because what the hell would they represent? 🙂

So, now that I’ve established that your question relates to asset pricing models and not market efficiency, let me dissappoint you by saying that I don’t really know the state of art asset pricing models. They get quite complicated and the math involved would take me some days… and it’s not the core of my research so I can’t spend toooo much time on thiss. Nontheless it’s a very interesting observation and I’m curious if a model incorporates this kind of stuff.